Few things are better than celebrating an all-time high from the heart of Bitcoin Country.

Last week, for the third year in a row, I had the opportunity to speak at the Adopting Bitcoin conference in El Salvador. Although the weather wasn't great, the excitement and optimism were palpable – another great experience.

The conference was full of Bitcoiners from the US, Canada, and Europe who have either recently moved to Latin America and become expats or are considering it. This includes myself, having moved from my native Canada to Mexico in 2021, at the height of the COVID lockdowns, in search of a freer place.

At that moment, my only criterion was to find basic freedom of movement, but since then I have had time to reflect on the long-term implications of my decision. I'm still convinced I made the right choice.

In this article, I'll explain in detail why I think Bitcoiners should consider moving to Latin America, and why many are already doing so.

You’ve all heard the classic arguments:

- Consistently warm weather due to the region's tropical or subtropical climates;

- Lower cost of living (e.g. Mexico is, on average, 46.9% lower than in the United States, according to Numbeo.);

- Proximity to the United States and Canada, with similar time zones;

- Latin American culture: strong family values, predominantly Christian religion, joyful outlook, and a 'mind your own business' attitude.

I will explore other arguments that people know less of:

- Easiness and low cost of immigration process;

- Lower tax burden through:

- Territorial tax systems;

- Simplified tax regimes;

- Lower geopolitical risk;

- Presence of bitcoin circular economies.

Ease of the Immigration Process

Here are the countries with temporary residency programs that are easy to qualify for and become permanent residents after a few years:

- Argentina Rentista Visa: proof of income over $30 USD (citizenship after 2 years);

- Mexico Temporary Residency: proof of income over $3319.04 USD (may vary);

- Panama (Tax) Residency via Company Formation: be from a “Friendly Country”;

- Paraguay Temporary (Tax) Residency: just a criminal background check;

- Uruguay Residency: proof of income $1500 USD.

And those that give you immediate permanent residency:

- Dominican Republic Rentista / Pensionado Visa: 2000$ / month in passive income;

- El Salvador Independent Worker Visa: just a criminal background check;

- Mexico Permanent Residency: proof of income $5531.73 USD (may vary);

- Peru Rentista Visa: proof of passive income $1000 USD (with citizenship obtainable after 2 years).

It’s important to note that:

- Most temporary residencies convert to permanent status after 2–4 years. Most citizenships require 4-6 years of total residency;

- Almost every country in the Americas offers birthright citizenship without restrictions or, in the case of Colombia, with few restrictions. Countries like Argentina, Brazil, and Peru are prevalent for birth tourism due to their relatively quick citizenship process (2 years);

- Other documentation requirements that vary from country to country, such as birth certificates, apostilles, criminal background checks, Interpol clearances, marriage certificates, translations, and in some rarer cases, vaccination records and other medical tests;

- Legal services range from $2,000 to $5,000, but some (as in the case of Panama) can be more expensive.

I recommend the services of My Latin Life (unsponsored), who's a personal friend, but also a great reference on the topic of moving to Latin America. I recorded a podcast with him where we talk about Swapido, listen to it here.

Let's discuss tax policy, starting with territorial tax jurisdictions in Latin America.

Territorial Tax Countries

In these countries, you don't have to pay taxes on foreign income. This includes a salary from your current employer (if they’re okay with it), or income derived from a company based in a tax haven, or you can set up a company in a tax haven, pay yourself a dividend, and pay absolutely no taxes anywhere.

The territorial tax countries in Latin America are:

- Guatemala;

- El Salvador;

- Honduras;

- Dominican Republic;

- Nicaragua;

- Costa Rica;

- Panama;

- Paraguay;

- Uruguay;

- Bolivia.

Basically, the pattern here is all of Central America, the Caribbean, and the smaller countries in South America. Hence, small countries.

Simplified Tax Regimes

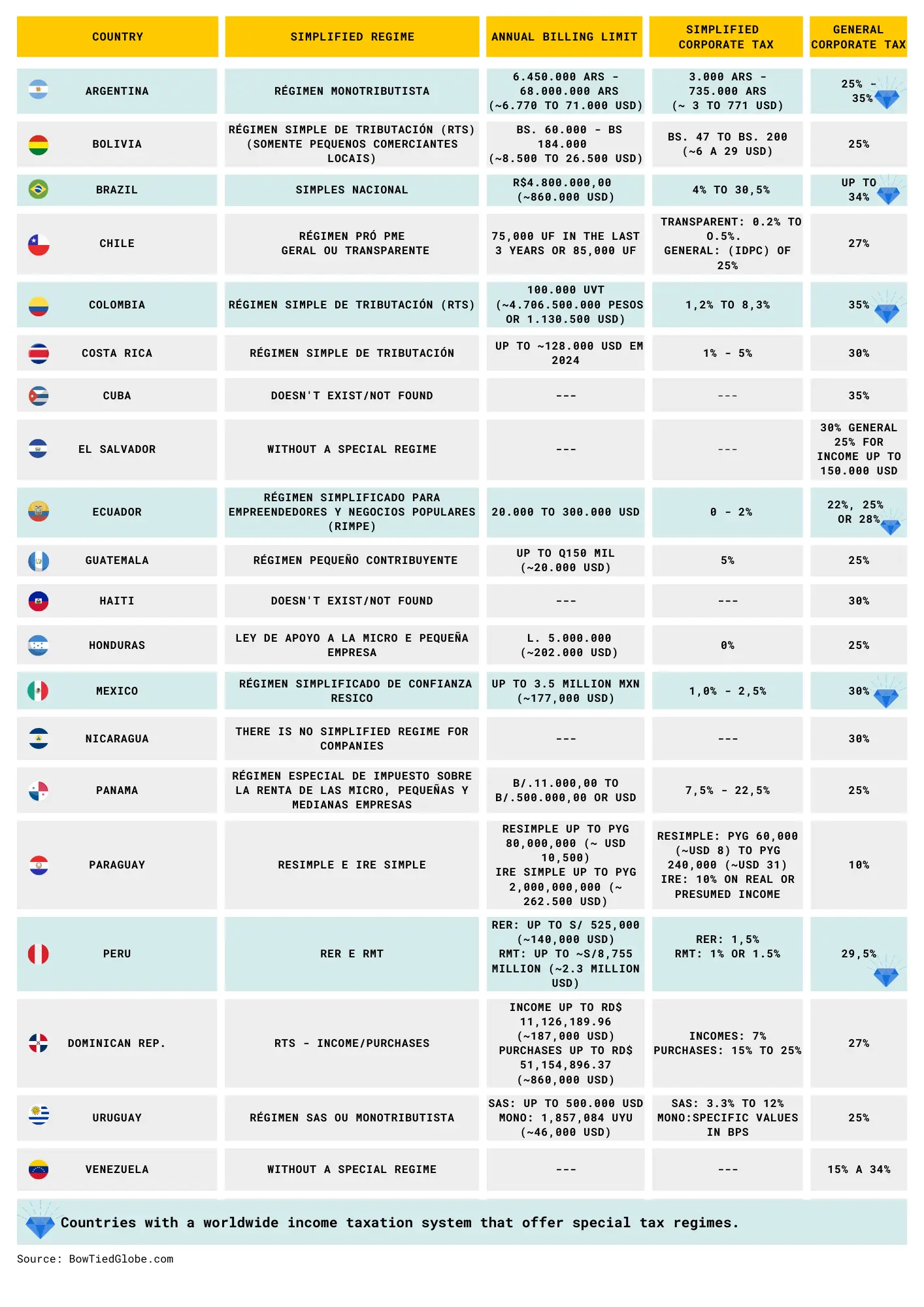

Most Latin American countries have adopted simplified tax regimes to formalize large sectors of the economy that were previously informal and therefore untaxed. In Mexico, the informal economy accounts for an estimated 60% of the workforce and 23% of GDP, according to the country's central bank. There are additional administrative, compliance, and economic reasons for the adoption.

Here’s an amazing table created by BowTiedGlobe with all the information you need on simplified tax regimes in Latin America. I recommend following him so you don't miss out on his great content.

There are many great examples of this, but my favorite is the RESICO program in Mexico. Introduced in 2022 by Mexico's populist, left-leaning administration, it allows you to pay a maximum of 2.5% tax on up to $175,000 of annual income.

Does it get better than living in Mexico and paying 2.5% income tax? I find that hard to believe.

Lower Geopolitical Risk

With the Ukraine war and now the Israel war, the global geopolitical scene is heating up. Lately there seems to be some optimism about a second Trump term and an end to these wars, but the long term risk prevails. You might ask, what region is safe from this? Allow me to present another Latin American option for consideration.

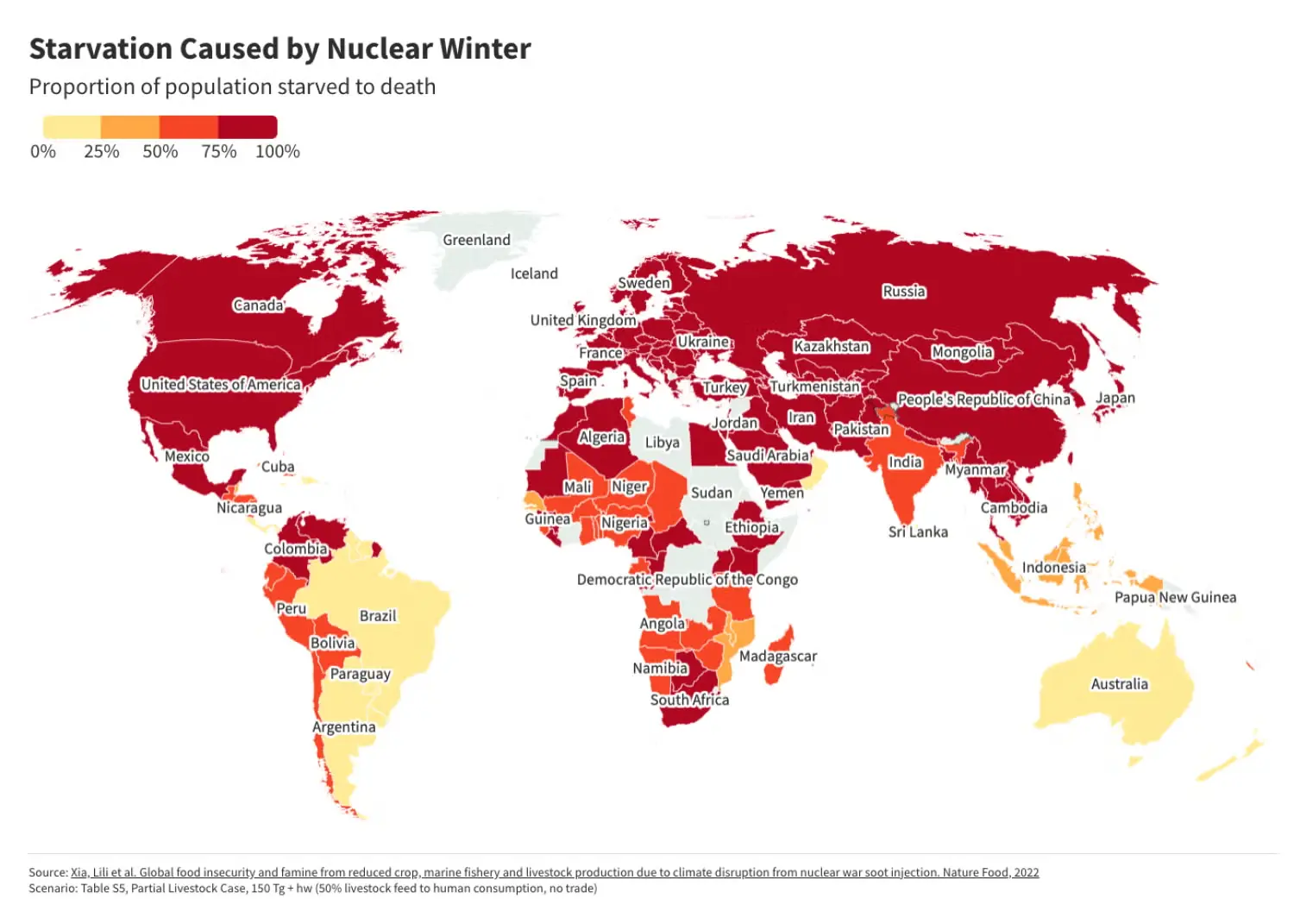

This is an extreme scenario, but even then, when most of the world's population has starved to death, the southern countries of Paraguay, Uruguay, Argentina, and Brazil (along with Australia and New Zealand) survive a large-scale nuclear war.

That's extremely unlikely. More realistically, tensions will continue to rise in the proxy war regions of Eastern Europe, East Asia, and the Middle East. Keep that in mind the next time you're told about other expat locations like Georgia, Dubai, and Thailand. Let's hope for the best for everyone in the world, but I recommend preparing for the likely bad scenarios.

Bitcoin Circular Economies

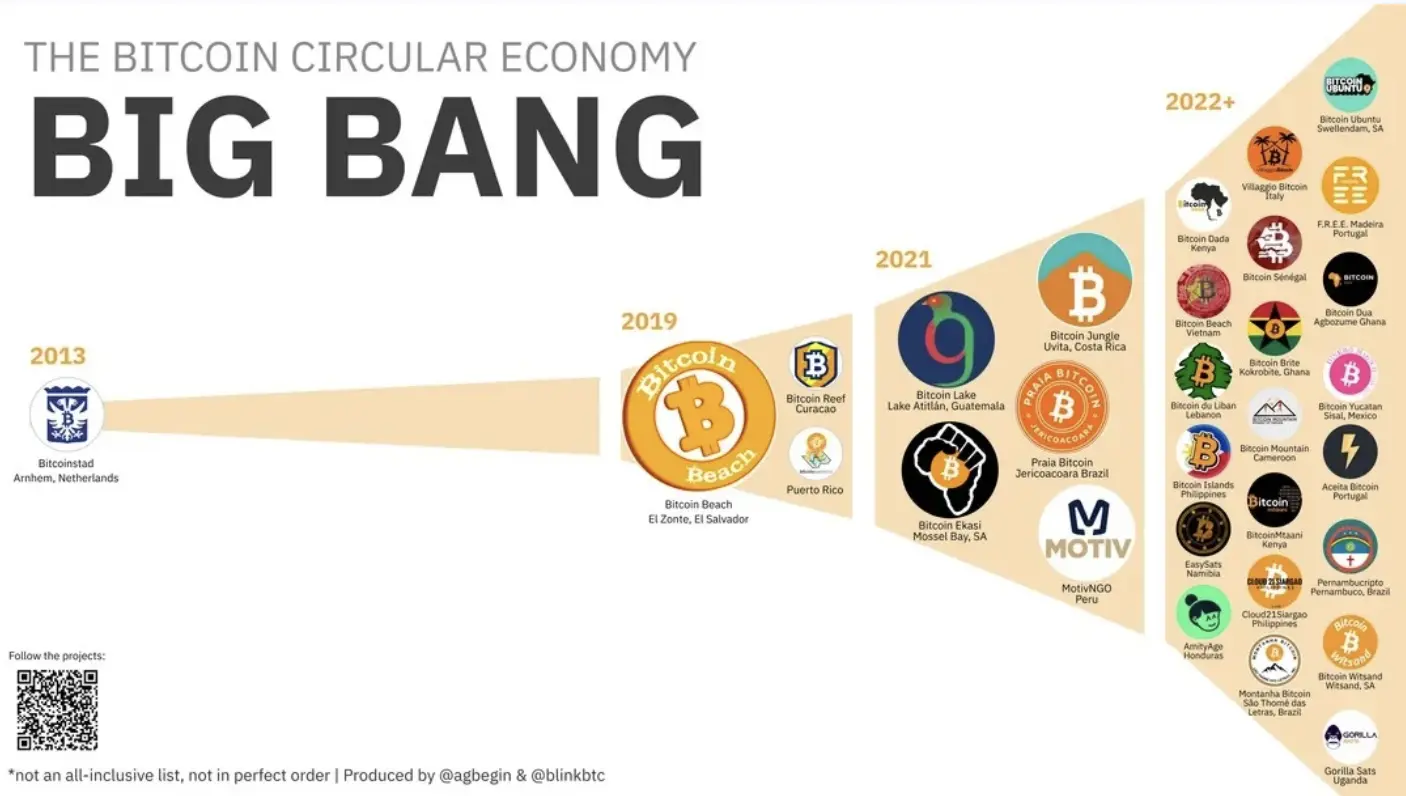

On a more optimistic note, Bitcoiners love to move to and visit Latin America because of the strong presence of circular economies and communities. Bitcoin offers a solution to many of the region's problems. Such as access to electronic payments for the unbanked, a hedge against inflation, circumvention of capital controls, and lower remittance fees.

I’ve had the chance to visit Bitcoin Beach in El Salvador, and Bitcoin Jungle in Costa Rica, and I recommend this experience to everyone. I also recommend reading my blog post on Bitcoin communities in Mexico if you haven't already. I predict that this trend will continue to grow throughout the continent (and the world).

Conclusion

There are many reasons why you wouldn't want to move to Latin America, such as high crime rates, lower wages, corruption, low trust, lower education, absurd regulations, slow government processes, weak institutions, inequality, poor infrastructure and public systems, climate and weather issues, and more.

Every country has its pros and cons, and people have different priorities. For example, I live in Mexico City and find it safe and easy to get by. I feel like it's as close as one can get to living in a developed country, and I've heard similar stories about Uruguay, Panama, Costa Rica, and other parts of Mexico.

Of the people who move here, many move back, but expats are generally very happy with their decision to move to Latin America. For example, in Mexico, 80.6% of expats report being happy with their decision to move.

If you're visiting Mexico or living here, you may want to use Swapido to pay for things. You can sign up with a foreign ID (you don't need to be a Mexican resident), and you can use it to send money to any bank account in Mexico using bitcoin from your own Lightning Network wallet.

It takes less than 30 seconds to complete a transaction, and everyone in Mexico accepts bank transfers as a form of payment, so you can get around the country using only Bitcoin. Sign up here.

Thank you for reading the article. Feedback and suggestions are welcome.